Treeline Research has recently completed the first phase of its 2024 Paper Suppression Study: Transactional Communications. The firm surveyed 150 U.S. banking, insurance and other financial services companies and 1,000 consumers to better understand the factors driving the shift from mailed communications to digital experiences. Later this year, the study will expand to healthcare.

In this blog, Andy provides key insights into customer communications and payments, drawing on the research findings and his distinguished career in printing and customer communications market research.

Key trends in transactional customer communications

We live in a digital-first era where customer communications and interactions are not just digital-first, but increasingly mobile, providing anytime, anywhere access to receive communications, check account history and make payments.

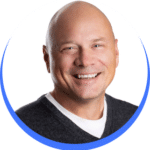

Digital Utilization

Question: Q20 How frequently do you utilize digital methods such as email, mobile apps or provider websites to receive and access communications, or interact with your bank, insurance, credit card or financial services company?

Source: 2024 Paper Suppression Study: Customer Survey | January 2024| Sample Size N=1,000 US Customers of Banks, Insurance, Credit Card & Financials Services Companies | Not for distribution without permission ©2024 Copyright Treeline Research, LLC

Any process that can be digitized, will be digitized, especially in the realm of customer communications, driven by the need for automation, improved customer experience (CX) and cost savings.

Sending an email with a link to a PDF version of a bill or statement in an archive is a digital alternative to regular mail. But simply enabling customers to access print documents digitally misses out on a strategic opportunity for deeper engagement with customers.

This approach is a one-way communication and represents the most basic form of digital delivery. Businesses that stay with this type of emailing bills and statements will find themselves farther and farther behind competitors that are delivering digital experiences that consumers expect and want.

Digital communications vs. digital experiences

Customer communications today are about having conversations. By using text messaging, email and innovative new technologies, companies can increase interaction and customer satisfaction, changing a monthly bill into hyper-personalized statement experience.

Personalized digital experiences are tailored to the unique preferences, behaviors, and needs of each user. This upgraded form of communications can:

- make targeted special offers, such as a discount or promotion of a new service

- react to missed payments by offering custom payment plans in the next statement

- provide useful information, such as a schedule of new-parent classes in medical bills covering labor and delivery.

Digital experiences also are:

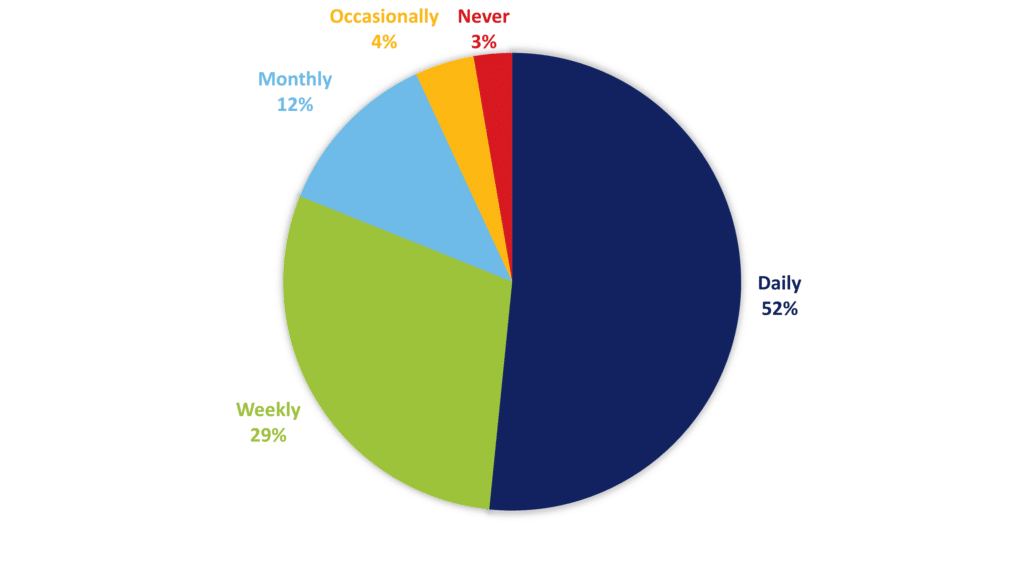

Secure. The perceived lack of security is holding back some print and mail consumers from switching to digital. They are looking for stronger safeguards and data protection that can come from new modern technologies.

What Would Improve Trust in Digital

Question: Q37 What would most improve your trust in digital/paperless communication methods from your service providers?

Source: 2024 Paper Suppression Study: Customer Survey | January 2024| Sample Size N=354 US Customers that trust printed and mailed communications the most. (Q35) | Not for distribution without permission ©2024 Copyright Treeline Research, LLC

Seamless. Consumers expect companies to know them and their up-to-date dealings with that business, whether they are calling, logging into an online portal, or receiving emails, text messages and mailed communications. Companies and their customer-facing operations need to manage accounts across channels in real-time.

Easy. This essential quality covers everything from statement formats that make it simple to find key information, including due date and total due, to requiring as few steps as possible to complete the desired action, such as make a payment.

Convenient. Consumers want a choice for how, when and where they receive communications. They also want the option of self-service, for viewing bills, searching account history, and related tasks, such as setting up recurring payments or making a payment using their preferred method, including credit or debit cards, ACH or third-party methods such as PayPal or ApplePay.

Big benefits from digital consumer experiences

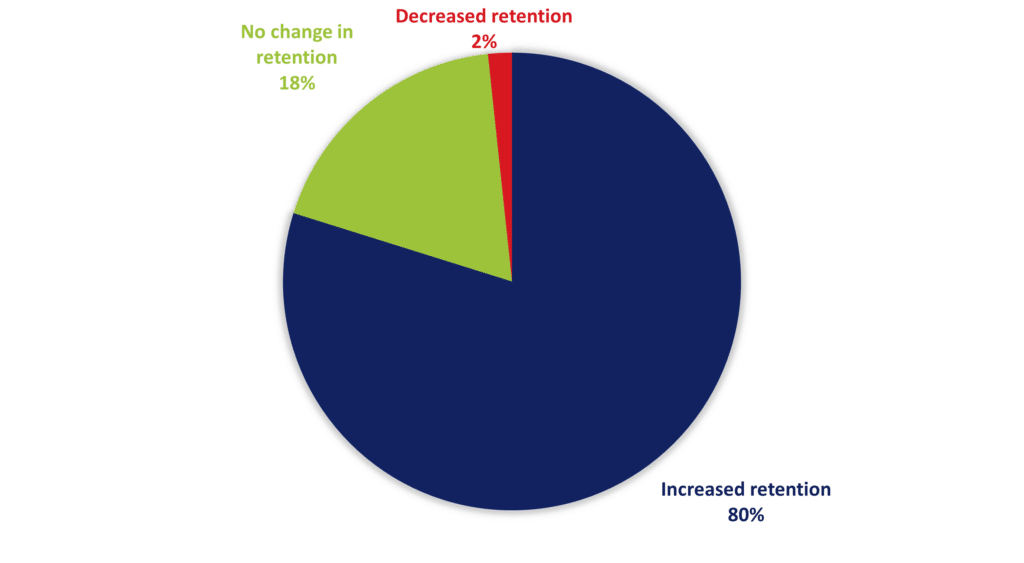

Our research found 80% of companies report that customer retention has increased due to digital experiences. Companies also say digital delivery of bills, statements, account updates, reminders and alerts overwhelmingly provide the most engaging CX.

Digital Increases Customer Retention

Question: Q20 Do you believe your company’s shift to digital/paperless communications has an observable impact on your customer retention?

Source: 2024 Paper Suppression Study: Business Survey | April 2024 | Sample Size N=150 US Banks, Insurance & Financial Services Companies | Not for distribution without permission ©2024 Copyright Treeline Research, LLC

The future of print communications

Print communications are in decline as consumers increasingly favor digital interactions with businesses, and postal rates and other costs keep rising. To rein in costs, 80% of U.S. financial services companies have put strategies in place to suppress paper, with another 11% planning to do so. Printed and mailed communications can no longer be the default for any business.

While the shift towards digital experiences is undeniable and necessary for staying competitive, it’s crucial for businesses to navigate this transition thoughtfully. A holistic approach calls for balancing the benefits of digital experiences with the unique advantages of print communications, including:

- Personal touch and tangibility. Despite the push towards digital, printed communications offer a tangible, personal touch that digital communications often lack.

- Regulatory and legal compliance. Certain communications still require physical mail to comply with legal and regulatory requirements.

- Customer preference. Not all customers are ready to fully embrace digital communications. By providing a choice between print and digital, businesses can cater to a broader audience and accommodate varying levels of digital literacy and comfort.

The journey from print communications to digital experiences is not a straightforward path but a dynamic evolution. Businesses must remain adaptable and innovative, leveraging the strengths of both print and digital to meet the changing needs and preferences of their customers. Partnering with a leading communications services provider like Nordis will give your business a competitive edge, enhancing customer experience while also ensuring compliance with evolving regulations.

For more on this topic, see our blog: Digital vs. Print Bill Presentment Solutions: Which Is Best for Your Customers?

Andy Young is the Owner & Principal Analyst of Treeline Research.

Connect with Andy on LinkedIn.